SBA Economic Injury Disaster Loans helped provide a lifeline to businesses during the pandemic. The cutoff for applying for funding is Dec. 31.

BY NATALLIE ROCHA | SMALL BUSINESS REPORTER, THE SAN DIEGO UNION-TRIBUNE

As the year ends, so do many of the funding programs that helped small businesses through the coronavirus pandemic.

The deadline for a U.S. Small Business Administration (SBA) COVID-era program is only a couple of weeks away and they are advising business owners to submit their online applications and reach out with questions before Dec. 31.

EIDL Explained

The SBA’s COVID-19 Economic Injury Disaster Loan (EIDL) program provides working capital to help businesses meet operating expenses and rebound from the pandemic.

Applications for this federal relief program will be accepted until Dec. 31 and will continue to be processed after this date until funds run out, according to the SBA.

The EIDL program provides low-interest, fixed-rate loans directly from the SBA that must be repaid. Businesses can also apply for the program’s Targeted EIDL Advance or Supplemental Targeted Advance, which is money from the SBA that does not need to be repaid.

Keep in mind, whether you are shooting for a first-time EIDL loan, an increase on an existing EIDL loan or a Targeted Advance, business owners must apply and be approved for an EIDL loan first and foremost as part of the process.

The Track Record

Nationwide, the SBA has approved approximately 3.85 million EIDL program loans for a total of around $308 billion as of Dec. 8. In California, the SBA has approved 583,620 EIDL loans worth about $55 billion in total, which is the largest total amount distributed to a state.

Get Assistance Beyond Relief

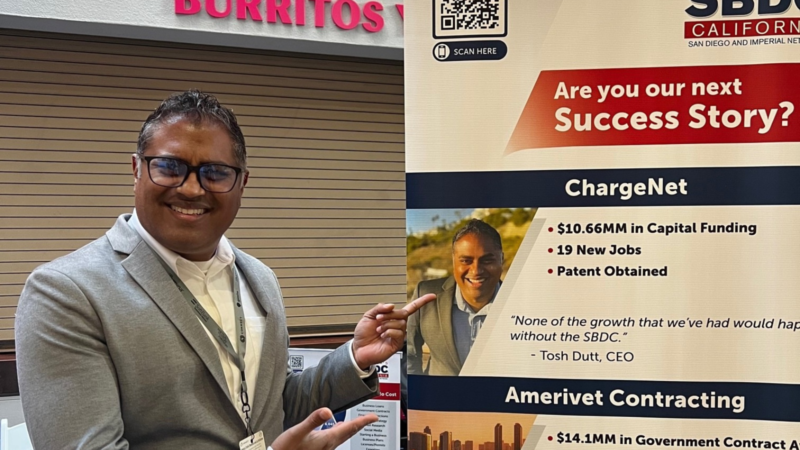

If business owners need help filling out the online application or have concerns about language or technology barriers, the San Diego & Imperial Valley Small Business Development Center (SBDC) Network offers no-cost assistance.

Recently, the SBDC hosted a webinar that discussed the EIDL loan program with a panel of six community lenders and what small business owners need to know about connecting with capital in the new year. Read the full story here for three takeaways from local community lenders on how small businesses can prepare for 2022.